PROFIT EXPLOSION for your business

I would be a multimillionaire for the amount of small business owners that complained to me about not making enough money, struggle to stay afloat, cannot keep track of their expenses, the stress of being a business owner, etc. The list can go on and on. If you see yourself between these lines, you are one of 95% of small business owners.

I can accurately guesstimate the current state of your business by asking a few simple questions.

- Do you utilize the business debit / credit card for personal purposes? (If your answer is YES, your business most likely struggles with cash flow)

- Do you pay your personal rent, schools fees etc from the business bank account? (If your answer is YES, you and your business most likely struggle with cash flow)

- Do you have different bank accounts for the various activities of the business? (If your answer is NO, you have very limited control over the finance of the business and you are most likely to keep up with payments to suppliers, SARS and yourself)

- What marketing / advertising do you make use of? (If the answer is NOTHING, you struggle with new lead and / or sales, which put cash flow under pressure).

For the moment I want you to forget about all the excuses for not doing / or doing the above, and really audit / assess if the current method used are the best for the financial health of the business or yourself.

Let me state a few suggestions, and then we can deconstruct the ideas:

- TODAY, separate your business and personal account. You are an employee of the business and might own the business through shares, but you are not the business itself. Remain separate.

- Open different bank accounts for various needs. Few ideas to think about in the meantime. Tax account, Profit share account, Bonus provision account, Projects account.

- Overheads assessment.

- Lead generation and sales review.

Separate your business and personal bank accounts

This is a simple idea, yet only 5% of business owners are sticking to this. This idea alone with change the financial landscape of your business. By living from the business bank account, you have NO CONTROL over the transactions and funds in your business.

Countless times I had showed a business owner his monthly drawings from the business, and he is shocked to learn that he has spend R 1 million per annum on personal expenses running through the business bank account. Your personal income is not only the salary you pay out to yourself, but also the personal card transactions, and other personal expenses (home rent or bond, groceries, school fees, etc ), paid from the business bank account.

Stop reading this and grab a pen and paper.

Write down ALL your personal expenses, one by one. This can be currently paid from your personal or business bank account but include both on this list. This list with be the NET amount that you must receive from the business monthly. Disclaimer, this is not to say the business can afford it, but at least you now have a clear picture of the current personal budget and salary needs.

Ask you accountant, or contact us if you are looking for one, to assist you in working out the GROSS amount of your salary. This amount (and UIF and SDL) will be the cost to your company. This would be the amount the business needs to make a provision for to be able to afford your currently salary drawn from the business. You will not make any further daily drawings from the business but will now receive a monthly salary. If you struggle with the new structure, add yourself on the weekly payroll, then on the fortnightly payroll, up to the point that you will be able to reach the goal of a monthly salary.

This is your first step to the PROFIT EXPLOSION for your business. Now the big step to help you ORGANISE your cash flow.

Cash Pocket Accounts

This idea can be done in various ways, I will merely state my proven method to you.

My mother used to keep her monthly budget in a safe, with envelopes for their various expenses.

This method made sure for two things:

- She made a provision for each expense or provision in advance.

- It keeps you from spending money monthly you don’t have, and make you examine your current expenses.

The best example I know for this is the toothpaste metaphor. When you have a new full toothpaste, you will go big and use big plashes on your toothbrush. Not a problem in the world. As you get to the end of the toothpaste, you will twist, turn and squeeze to get that last bit out, even with some effort.

The toothpaste metaphor is a great example of how people tend to use resources when they have an abundance of them, without thinking much about the consequences, but when the resources become scarce, people tend to conserve them and make the most of what's left. This principle applies not only to toothpaste but also to many aspects of life, including personal finances.

When people have a lot of money or credit available, they tend to spend more than they need to and may not pay much attention to their spending habits. However, when they have limited funds or are trying to pay off debt, they become more mindful of their spending and look for ways to cut back and stretch their resources further.

Let me be clear. I believe in the abundance energy of money (as with anything else), and money must not be hold against your chest as a form of scarcity. Using this PROFIT EXPLOSION method, will help you to MANAGE the money of your business.

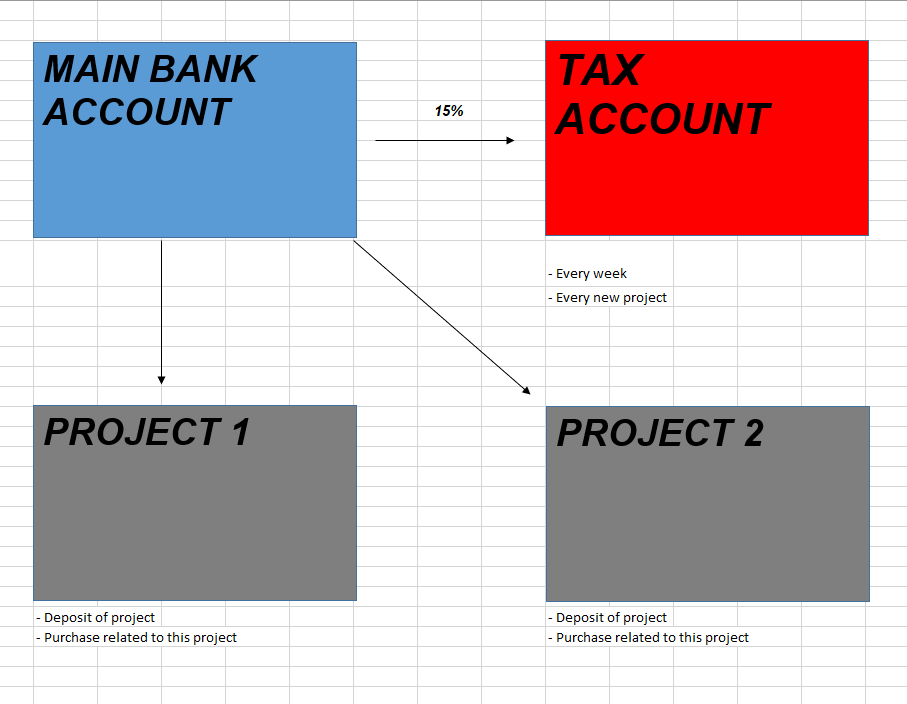

Allow me to get very practical with you, to illustrate this concept, with the below scenario as an example. (See Figure 1)

ABC construction (Pty) Ltd trade with a valid VAT number and is currently busy with two projects. ABC receives R 115 deposit in the bank to start to project one.

ABC will have opened their current MAIN BUSINESS BANK account, and also open 3 different bank accounts (or holding accounts) with names TAX account, PROJECT 1 account and PROJECT 2 account.

ABC receive the deposit of R 115 in the MAIN BANK ACCOUNT. On the date of the receipt, ABC transfer the VAT on the amount of the deposit (R 115 *15 /115) = R 15, to the TAX ACCOUNT. (The funds in this account may only be used for the purposes of VAT payable to SARS)

One the same day ABC transfer the difference (R 115 less R 15) to the PROJECT 1 account.

The funds in this account may only be used for the expenses of Client: Project 1)

This safeguard you from using deposit fund for any other project than for the client it is intended for. You will be surprises how many businesses are being liquidated with deposit of people paid, and not being able to be paid, because a lot of business use the deposit of a new project account may only be used for the purposes of VAT payable to SARS) to finish a previous project. This cycle forces you to ALWAYS looking for another project to finance previous ones. Its also become a problem in that the client work are being rushed to receive final payment, without showing the care and professionalism that the business might have intended for the project.

This method is perfect to keep your funds allocate to the intended purpose for it.

Figure 1

If you do not work on big and various projects but receive frequent payments from various clients during the course of the month, you might want to adapt the process do work better for you.

On a weekly basis, add up the total receipts for that week, and work out the VAT amount on that. (You can use the same formula. Total amount x 15 / 115). Transfer this amount to your TAX account, to keep it aside for your bi-monthly VAT payable.

Overheads Assessment

Truth is, we spend way to easy when money is flowing during summer times of your business and then end up with way too much debt and / or overheads during the winter times. That is one of the main reasons that business is being liquidated during recessions. We extend ourselves too much. Point.

Make a list of ALL the business expenses, including monthly repayments of debt.

I am sure you will quickly see several expenses that you don’t require anymore, and secondly with some effort you will find ways to decrease some of the other expenses.

If you keep your eyes on this list for the weeks and months to come, you will become creative in finding ways to continuously find ways in shaving something off from your overheads.

Though, over time, you will find that you can only shave these expenses to a certain point, and that expansion is your only further option. That is where advertising, marketing and brand buildings comes in.

Lead generation, brand building and sales

Lead generation, brand building and sales might be in the same category, but it is three different things, processes.

Lead generation:

Lead generation refers to the process of identifying and attracting potential customers or "leads" who are likely to be interested in a product or service offered by a business. The ultimate goal of lead generation is to gather contact information from individuals or organizations who have shown an interest in what the business has to offer. This contact information can then be used to initiate communication and nurture the leads further along the sales funnel, with the aim of converting them into paying customers.

Lead generation can be carried out through various channels and strategies, both online and offline. Here are some common methods we utilize in lead generation:

1. Using content marketing by creating and sharing valuable content in blog (website) or video format (YouTube or Social media) to attract and engage potential leads. Adding value attract your audience and customers.

2. Niche market websites can create an abundance of leads if your SEO specialist can perform and have your searched keyword pop up on page 1 of google.

3. Designing dedicated web landing pages with a specific call-to-action (CTA) to capture visitor information. Landing pages usually offer something of value, such as a free trial, a downloadable resource, or a newsletter subscription, in exchange for contact details.

4. Building an email list by encouraging website visitors or customers to subscribe to newsletters or updates. Regularly sending relevant and personalized emails can nurture leads and encourage them to take the desired action.

5. Running online advertisements, such as pay-per-click (PPC) campaigns on search engines like Google or display ads on websites, to target specific demographics and drive traffic to landing pages or lead capture forms.

6. Referrals and Word-of-Mouth: Encouraging satisfied customers to refer others or leave positive reviews can be a powerful form of lead generation. It leverages the trust and credibility established by existing customers.

Read more about my marketing and value add strategy in this article

To follow my DRAFT notes of my new book, BLACKBELT ENTREPRENEURSHIP, follow this link for updates